BTC Price Now: How to Make Informed Investment Decisions

Bitcoin, the leading cryptocurrency, continues to capture the interest of investors worldwide. Understanding the current BTC price, analyzing its trends, and making informed investment decisions are crucial for both novice and seasoned investors. This article explores how to interpret BTC price movements and develop effective investment strategies.

Understanding BTC Price Trends (Historical Patterns and Influences)

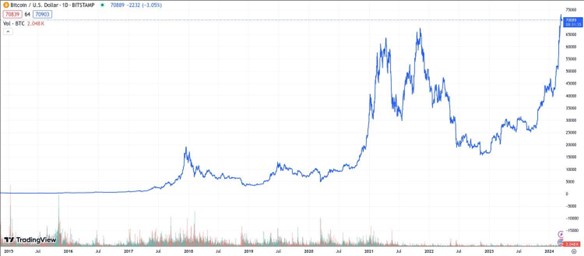

Bitcoin koers (price) history is characterized by significant volatility and cyclical trends. Major events such as regulatory changes, technological advancements, and macroeconomic factors have influenced its price. For example, the 2017 bull run saw Bitcoin reaching nearly $20,000, followed by a prolonged bear market. Recognizing these patterns helps in anticipating future movements.

Factors Impacting Price

Several factors impact btc price now. These include market demand, investor sentiment, macroeconomic indicators, and technological developments. Additionally, external factors such as regulatory news and geopolitical events can lead to rapid price changes. Understanding these elements is essential for making informed investment decisions.

Analyzing BTC Price (Technical Analysis)

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Tools such as moving averages, Relative Strength Index (RSI), and Bollinger Bands are commonly used to identify trends and potential entry or exit points. Technical analysis can help investors understand market behavior and make data-driven decisions.

Fundamental Analysis

Fundamental analysis evaluates Bitcoin’s intrinsic value by considering factors such as adoption rates, network activity, and macroeconomic conditions. Events like Bitcoin halving, which reduces the reward for mining new blocks, can significantly affect supply and demand dynamics. By assessing these factors, investors can gauge the long-term potential of Bitcoin.

Strategic Approaches (Long-Term vs. Short-Term)

Investors can adopt either a long-term or short-term approach depending on their risk tolerance and investment goals. Long-term strategies, such as holding (HODLing), are based on the belief that Bitcoin’s value will appreciate over time. Short-term strategies, such as day trading, capitalize on short-term price fluctuations.

Market Timing

Market timing involves attempting to buy low and sell high by predicting market movements. While challenging, this strategy can be lucrative if executed correctly. It requires a thorough understanding of market indicators and correct btc price prediction. Using tools and staying informed about market news can aid in better timing of trades.

Diversification and Risk Management (Portfolio Allocation)

Diversification involves spreading investments across various assets to reduce risk. For cryptocurrency investors, this means not only investing in Bitcoin but also in other altcoins. Proper portfolio allocation balances risk and potential returns, providing a buffer against market volatility.

Hedging Strategies

Hedging involves using financial instruments to offset potential losses in investments. For Bitcoin investors, this could mean using options or futures contracts to protect against adverse price movements. Implementing hedging strategies helps in managing risk and stabilizing returns.

Case Studies and Examples (Successful Strategies)

Examining successful investment strategies can provide valuable insights. For instance, early adopters who invested in Bitcoin before major bull runs reaped significant rewards. Understanding the reasoning behind their strategies and the market conditions at the time can offer lessons for current investors.

Lessons from Volatility

Bitcoin’s history is rife with volatility. Analyzing past volatile periods and the market’s reaction helps in understanding how to navigate future turbulence. Learning from these lessons can improve risk management and investment decision-making.

Conclusion

Making informed investment decisions in Bitcoin requires a comprehensive understanding of its price trends, strategic analysis, and effective risk management. By combining technical and fundamental analysis, adopting appropriate strategies, and learning from past experiences, investors can navigate the complexities of the Bitcoin market and capitalize on its potential.